How to recession-proof your life

Are we in a recession?

Republicans are already calling it the Biden recession. The White House is trying to downplay and deflect that idea. Good Day talked to Dr. Julia Coronado, an economist at the University of Texas in Austin. She answers the question, 'Is this a recession or not?'

Prices for gas, food and rent are soaring. The Federal Reserve has raised interest rates to the highest level since 2018. The U.S. economy has shrunk for two straight quarters.

Economists are divided over whether a recession is looming. What’s clear is that economic uncertainty isn’t going away anytime soon. But there are steps you can take now to be ready for whatever is ahead.

Yiming Ma, an assistant professor at Columbia University, says it’s not a question of if but when a recession will happen. People should prepare but not panic, she said.

If you think a recession could destabilize your finances, here are some things you can do to prepare.

Know your expenses and make a budget

Knowing how much you spend every month is key. Ma recommends sitting down and writing how much you spend day-to-day. This will help you see what’s coming in, what’s going out, and which unnecessary expenses you might be able to cut.

Budgets often reveal expenses that can be eliminated entirely or impulsive spending that can be avoided with planning.

RELATED: Are we in a recession? The definition of recession explained

For guidance creating a budget, free courses such as "Creating a budget (and sticking to it)" by CT Dollars and Sense, a partnership of Connecticut state agencies, and Nerd Wallet’s Budget Calculator can be good places to start.

Save as you can

(Photo by Joe Raedle/Getty Images)

The more non-essential expenses you can cut, the more you can save.

Programs such as America Saves, a non-profit campaign by the Consumer Federation of America, can help create a roadmap.

RELATED: How to save enough money for retirement

And if you have a savings account, it’s important to check whether your bank gives you a good interest rate and shop around if it doesn’t, Ma said.

Consolidate your loans, and don't take any more

As interest rates rise, experts recommend that you consolidate your loans to have just one fixed-rate loan and, if you can, pay down as much of your debt as possible. The Federal Trade Commission’s Consumer Advice guide for Getting Out of Debt can help you make a plan.

RELATED: How raised interest rates will impact consumers' household budgets

With interest rates high, it’s also not a great time to take out new loans for big expenses like cars, though experts do recommend that if you need durable goods such as vacuum cleaners, stoves or dishwashers, you buy them as soon as possible to avoid future price increases.

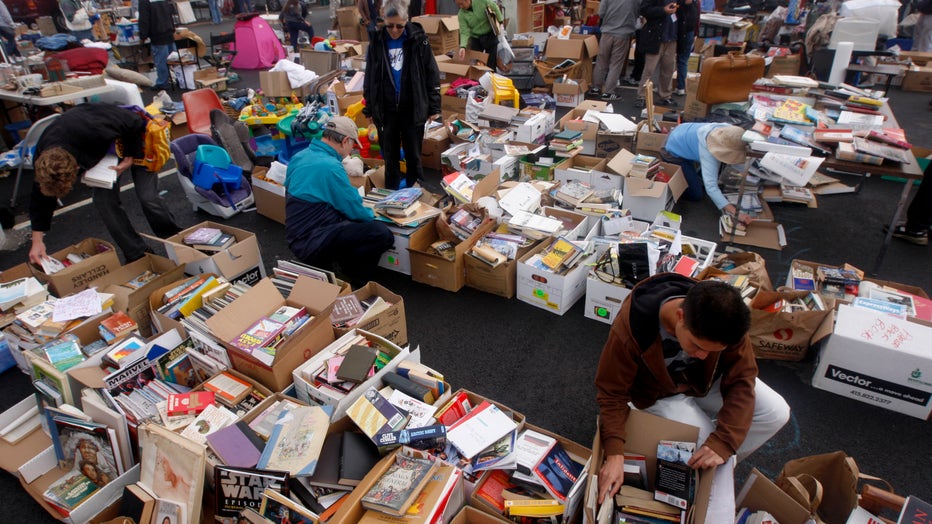

Visit second-hand stores and yard sales

Bargain hunters sort through hundreds of donated items at a garage sale fundraiser at CCSF in San Francisco, Calif., on Saturday, Oct. 24, 2009. (Photo By Paul Chinn/The San Francisco Chronicle via Getty Images)

Allen Galeon, an in-home caregiver in California, has been affected for months by the rising prices of household staples like groceries, paper towels, and gas for his commute.

RELATED: Here’s how much it costs to have a baby in the US, analysis finds

One choice he’s made is to buy items like clothes or electronics second-hand whenever possible, whether from Goodwill, pawn shops, or Craigslist. And Craigslist allows you to search by area, to cut down on driving — which means less gas and inconvenience.

Negotiate your monthly bills

Since the pandemic, many companies have updated their relief policies and have become more flexible with users, according to Kia McCallister-Young, director of America Saves.

Calling providers of monthly services to negotiate bills — whether it’s utilities, phone service, cable, internet, or auto insurance — can lead to meaningful savings, said McCallister-Young. Individuals can ask for the best rate, any available discounts, rebates, or coupons that can lead to a lowered monthly fee. If a provider is competitive with other companies, there’s an even better chance of getting a discount, she added.

RELATED: President Biden weighs extending student loan payment pause beyond August 31

Check out federal programs such as the Low Income Home Energy Assistance Program, which helps cover bills, and Lifeline, which can assist with phone bills. If you are unsure if you qualify for any federal or state program, you can call 211, which will connect you with a local specialist who can assist you.

Switch up your groceries

People shop for groceries at a supermarket in Glendale, California January 12, 2022. (Photo by ROBYN BECK/AFP via Getty Images)

Grocery shopping with a meal plan, buying generic rather than brand-name or purchasing in bulk are some of the recommendations from the Consumer Federation of America.

"A lot of stores have price matching, so if you show them that a competitor is selling the same product at a lower rate, they’ll match that," said McCallister-Young. "You also want to be looking at the stores that are closest to you, so you’re not spending the extra money you’d save on gas."

An alternative way to save money on groceries is to check out food sharing apps such as Olio, which connects people around their community to share extra grocery items, and Too Good to Go, where customers can buy businesses’ surplus food at a discount.

Look at government assistance programs

Even with these saving and spending practices, a month’s wages aren’t always enough to cover important expenses. If this is your situation, programs around the country are available to assist you.

RELATED: Nearly half of Americans will take on debt this year despite higher borrowing costs: survey

To make use of these resources, check if you qualify for the Emergency Rental Assistance Program, Supplemental Nutrition Assistance Program, Farmers Market Nutrition Program, or the Homeowner Assistance Fund. All of these are federal programs coordinated by state governments. Some states offer additional local programs for their residents.

Look for community assistance

If you are experiencing food or housing insecurity, look for non-profit or community organizations around you. From housing support and food banks to utility assistance, non-profit organizations around the country can help. National organizations such as Feeding America host food banks in all 50 states.

Food assistance organizations such as Ample Harvest, Hunger Free America and Food Rescue US offer maps that allow users to search a nearby food bank by typing their zip code.

Take care of your mental health

(Photo by OLIVIER DOULIERY/AFP via Getty Images)

Between worrying about the bills and not knowing what your financial future might look like, your stress levels can go through the roof.

RELATED: Stressed out: 4 in 10 women have reached their ‘breaking point,’ survey says

Most health insurance covers some type of mental health assistance. If you don’t have health insurance, you can look for sliding-scale therapists around the country, including through FindTreatment.gov and the Anxiety and Depression Association of America directory.